Unknown Facts About Pvm Accounting

Unknown Facts About Pvm Accounting

Blog Article

Unknown Facts About Pvm Accounting

Table of ContentsFascination About Pvm AccountingThe Ultimate Guide To Pvm AccountingThe Ultimate Guide To Pvm AccountingExamine This Report on Pvm AccountingThe 5-Second Trick For Pvm AccountingThe Ultimate Guide To Pvm AccountingFascination About Pvm Accounting

In terms of a firm's general approach, the CFO is liable for guiding the firm to satisfy financial objectives. Some of these methods might entail the company being obtained or acquisitions going onward.

As a business expands, bookkeepers can release up more personnel for various other service tasks. As a building company expands, it will certainly require the help of a full time economic personnel that's handled by a controller or a CFO to manage the firm's funds.

Some Known Facts About Pvm Accounting.

While big services may have full time financial backing groups, small-to-mid-sized companies can hire part-time accountants, accounting professionals, or economic experts as needed. Was this post practical? 2 out of 2 people found this useful You voted. Change your solution. Yes No.

Reliable bookkeeping practices can make a significant difference in the success and growth of building and construction firms. By carrying out these techniques, building and construction companies can enhance their monetary stability, improve operations, and make educated choices.

Detailed estimates and budgets are the foundation of building task management. They help steer the project in the direction of timely and rewarding conclusion while securing the interests of all stakeholders involved.

Pvm Accounting Can Be Fun For Everyone

An exact evaluation of materials needed for a project will help guarantee the required products are acquired in a timely way and in the best quantity. An error below can lead to wastefulness or delays due to material lack. For most construction jobs, tools is required, whether it is bought or rented.

Appropriate tools evaluation will aid make certain the best devices is readily available at the correct time, saving time and money. Do not fail to remember to make up overhead expenditures when estimating project expenses. Straight overhead costs are particular to a job and may consist of momentary leasings, utilities, secure fencing, and water products. Indirect overhead expenditures are day-to-day expenses of running your company, such as rent, management salaries, energies, tax obligations, depreciation, and advertising.

Another aspect that plays into whether a project succeeds is a precise quote of when the project will be finished and the associated timeline. This price quote helps make sure that a job can be completed within the alloted time and resources. Without it, a task may lack funds prior to conclusion, creating prospective job interruptions or abandonment.

See This Report about Pvm Accounting

Precise job costing can help you do the following: Understand the earnings (or do not have thereof) of each project. As job setting you back breaks down each input into a task, you can track productivity separately. Contrast actual prices to quotes. Handling and evaluating quotes enables you to much better rate jobs in the future.

By identifying these items while the project is being finished, you stay clear of surprises at the end of the job and can resolve (and hopefully avoid) them in future jobs. A WIP schedule can be finished monthly, quarterly, semi-annually, or annually, and consists of project information such as contract value, sets you back sustained to date, complete approximated prices, and complete job invoicings.

More About Pvm Accounting

Budgeting and Projecting Tools Advanced software application supplies budgeting and forecasting capacities, permitting building and construction business to prepare future projects much more accurately and manage their finances proactively. Record Management Construction tasks include a great deal of documentation.

Improved Supplier and Subcontractor Management The software program blog here can track and take care of settlements to vendors and subcontractors, guaranteeing prompt repayments and keeping excellent relationships. Tax Preparation and Filing Audit software can help in tax obligation prep work and declaring, making certain that all appropriate financial activities are precisely reported and taxes are filed in a timely manner.

What Does Pvm Accounting Do?

Our client is a growing advancement and building company with headquarters in Denver, Colorado. With multiple active building work in Colorado, we are searching for an Audit Aide to join our group. We are seeking a permanent Bookkeeping Aide who will certainly be liable for giving useful support to the Controller.

Obtain and review day-to-day billings, subcontracts, adjustment orders, acquisition orders, check requests, and/or various other associated paperwork for completeness and conformity with monetary policies, treatments, budget plan, and contractual demands. Update month-to-month analysis and prepares budget plan pattern records for building projects.

Pvm Accounting - Truths

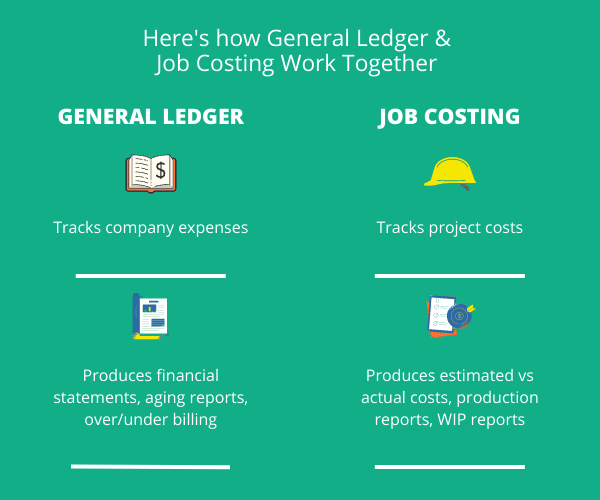

In this guide, we'll dig into various elements of building accounting, its significance, the criterion devices made use of in this area, and its role in building and construction tasks - https://peatix.com/user/22310354/view. From economic control and price estimating to capital monitoring, explore just how accounting can benefit construction tasks of all ranges. Building accounting refers to the customized system and procedures used to track financial information and make tactical choices for construction companies

Report this page